The Ultimate Guide to IR35 – Demo

Contents

Lorem ipsum dolor sit amet

Understanding IR35 and whether you fall inside or outside can be a challenge. Much information surrounds the legislation, its technicalities and how it could impact you as a contractor. Our comprehensive guide covers all you need to know. We’ll answer all of the frequently asked questions, such as “What is IR35?” and “How does IR35 work?” as well as look at the difference between inside IR35 and outside IR35 and how status is determined.

IR35’s nuances mean contractors can’t be expected to know the law inside out. Please only use this article as a guide. If in doubt, refer to HMRC’s website or seek professional advice.

What is IR35?

Navigating the intricate landscape of UK tax legislation is no easy feat, especially for contractors. Amidst the myriad of regulations, one term stands out prominently: IR35. But what is IR35, and why does it matter?

In this comprehensive guide, we delve deep into the heart of IR35. Whether you’re an aspiring contractor or a seasoned veteran seeking clarity, this guide aims to demystify IR35, empowering you with the knowledge to make informed decisions and remain compliant.

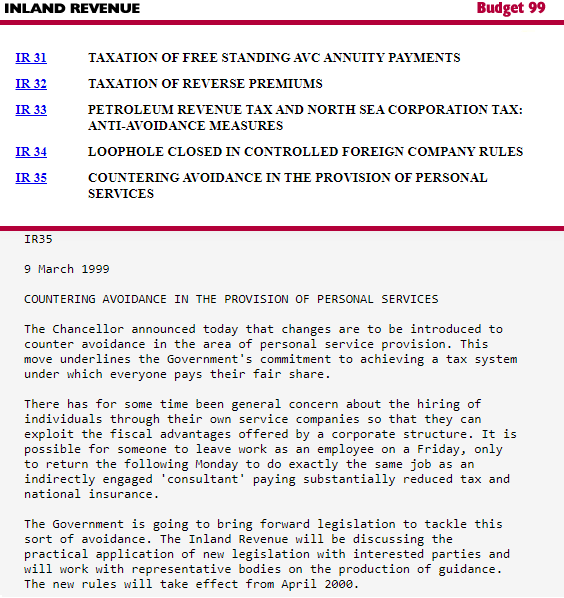

Background to IR35

Permanent employees and contractors are treated differently under UK law. If a contractor provides services through their own limited, they may take some of their pay in dividends instead of taxable salary.They can also offset several business expenses against Corporation Tax and pay less in National Insurance Contributions. This lower tax burden reflects the more significant financial risk of being self-employed.

HMRC introduced IR35 (or the ‘off-payroll working rules’) in 2000 to tackle ‘disguised’ employment. When a contractor is a ‘disguised’ employee, they take advantage of the tax efficiency of working through a limited company despite being treated and working as though they are an employee by the end client.

HMRC views these disguised employees as avoiding tax by taking advantage of the reward with none of the corresponding risks.The benefit for employers is that they don’t have to pay employers’ National Insurance contributions or give the contractors employee benefits. The benefit for contractors is that they can pay themselves through their limited company to minimise their tax burden.

Employer’s liability insurance covers you in the event of a compensation claim by an employee where they have suffered injury, illness or accidental death due to their employment. It is legally required if you have employees and unnecessary if you do not.

For contractors, if you are the director of your limited company, are the sole employee and own more than 50% of the shares, you are exempt. Costs start from around £60 per year and are an allowable business expense.

Employer’s liability insurance covers you in the event of a compensation claim by an employee where they have suffered injury, illness or accidental death due to their employment. It is legally required if you have employees and unnecessary if you do not.

For contractors, if you are the director of your limited company, are the sole employee and own more than 50% of the shares, you are exempt. Costs start from around £60 per year and are an allowable business expense.

Employer’s liability insurance covers you in the event of a compensation claim by an employee where they have suffered injury, illness or accidental death due to their employment. It is legally required if you have employees and unnecessary if you do not.

For contractors, if you are the director of your limited company, are the sole employee and own more than 50% of the shares, you are exempt. Costs start from around £60 per year and are an allowable business expense.

Employer’s liability insurance covers you in the event of a compensation claim by an employee where they have suffered injury, illness or accidental death due to their employment. It is legally required if you have employees and unnecessary if you do not.

For contractors, if you are the director of your limited company, are the sole employee and own more than 50% of the shares, you are exempt. Costs start from around £60 per year and are an allowable business expense.

What is IR35?

IR35 is an employment status test that determines whether a contract points towards employment or self-employment. It combats tax avoidance by closing loopholes, ensuring contractors working the same way as permanent employees pay the same taxes.

If your contract is ‘inside IR35’, it points towards employment. Your working arrangements are similar to those of a permanent employee, so HMRC imposes broadly the same income tax and national insurance liabilities. Working inside IR35 is usually done via an umbrella company that handles the administrative burden of paying the correct taxes. See our guide on umbrella companies for further details.

If your contract is ‘outside IR35’, it points towards self-employment, and you can enjoy the tax efficiency that self-employment brings (as well as all the associated risks). Working outside IR35 is usually done via a personal service company (‘PSC’). A PSC is a limited company set up by a contractor to provide their services; they are usually the sole shareholder and company director. See our guide on limited companies for further details.

'IR35' Meaning

How Does IR35 Work?

IR35 applies on a contract-by-contract basis; it does not apply once to your entire company. For each contract, the relevant ‘decision-maker’ (usually the end client) prepares a Status Determination Assessment (‘SDS’). The SDS looks at the engagement contract’s wording and the contractor’s day-to-day working practices and decides whether IR35 applies.

Three key factors are considered when assessing a contractor’s IR35 status:

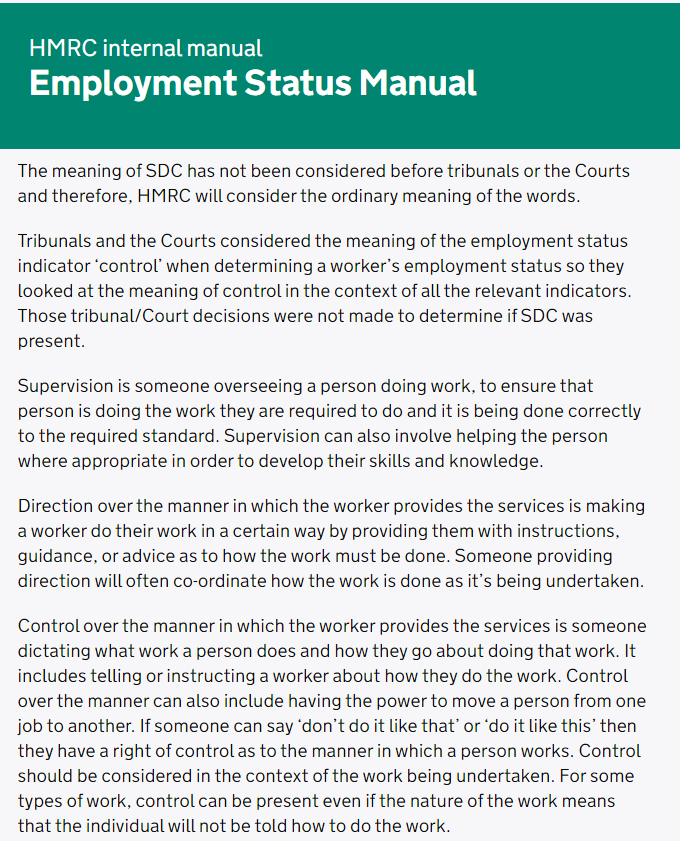

i) Supervision, Direction and Control

Does the contractor maintain autonomy over what work has to be done, when it has to be done, and where it has to be done? If not, this points to an employee-employer relationship.

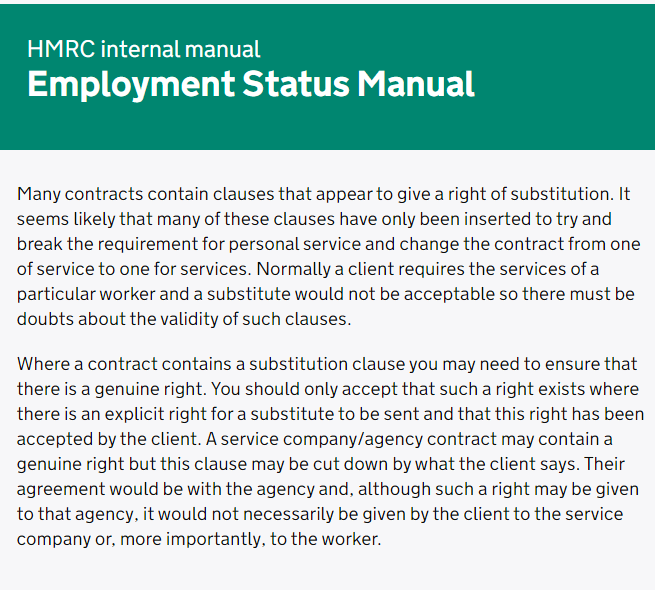

ii) Substitution

Does the contractor have the right to provide a qualified replacement in their place should they be absent for any reason? If not, this is an indicator that the contract is inside IR35.

iii) Mutuality of Obligations

Mutuality of obligations exists when an employer has a legal duty to provide work, and the employee has a legal duty to perform said work. It is a vital part of a traditional employee/employer relationship.

See our guide to The IR35 Rules for further information.

HMRC offer detailed guidance notes and an online tool to help decision-makers determine whether IR35 is relevant. Third parties also specialise in performing these assessments and providing insurance against a potentially incorrect determination.

Who Does IR35 Apply To?

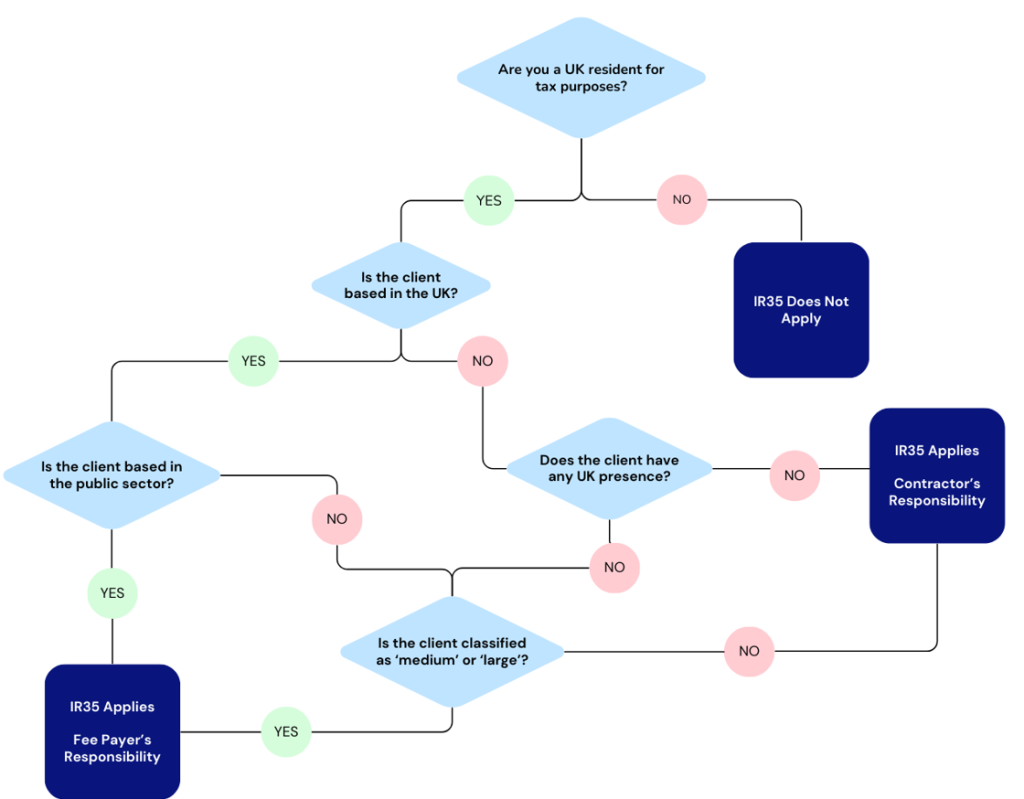

Any contractor that is a UK resident for tax purposes has the potential to be impacted by IR35. Although the party responsible for performing the SDS can vary, if you are a contractor paying tax in the UK, you need to consider IR35.

This is a point that often confuses contractors. They mistakenly believe that if a potential client is overseas, then IR35 doesn’t apply. Instead, they become responsible for the SDS, decide whether they are inside IR35, and hold the liability should this decision be wrong.

If you work outside IR35 through a limited company, HMRC could open an ‘IR35 enquiry’ into your circumstances. An IR35 enquiry reviews your engagement contract, working practices, and other relevant information to decide whether the decision maker is correctly classified as outside IR35.

If HMRC decides the original SDS was incorrect and you are a ‘disguised employee’, a deemed payment must be made. This payment is calculated as the additional Income Tax and National Insurance you would have paid if you were an employee, plus interest and any relevant penalties.

What is Inside and Outside IR35?

Navigating the intricate landscape of UK tax legislation is no easy feat, especially for contractors. Amidst the myriad of regulations, one term stands out prominently: IR35. But what is the meaning of ‘inside IR35’ and ‘outside IR35’, and why does it matter?

In this comprehensive guide, we delve deep into the heart of IR35. Whether you’re an aspiring contractor or a seasoned veteran seeking clarity, this guide aims to demystify IR35, empowering you with the knowledge to make informed decisions and remain compliant.

Inside IR35 Meaning

Working inside IR35 means that you have been caught by the IR35 rules, and HMRC regards the service you provide to be one of employment. You are considered an employee for tax purposes rather than a self-employed individual running their own business.

If you work inside IR35, you are subject to the same income tax and National Insurance contributions as a permanent employee. You can not utilise the salary and dividend structure in the same way you can while working outside IR35 via a limited company. Instead, you are paid via PAYE.

Paying a contractor via PAYE requires a fee-payer to run payroll. Most clients do not want to take contractors onto their payroll directly; instead, they prefer to engage contractors via an intermediary such as an umbrella company.

Trading While Inside IR35

i) Umbrella Company

An umbrella company acts as an intermediary between the contractor and the end client, charging a small margin to handle the administrative task of running PAYE. The contractor submits a timesheet, and the umbrella company invoices the client.

Once the client pays the invoice, the umbrella company deducts income tax, National Insurance, and employer costs (employer’s National Insurance, apprenticeship levy, and umbrella margin). The net amount is then paid into the contractor’s personal bank account.

ii) Agency PAYE

With agency PAYE, the contractor is enrolled into the recruitment agency’s PAYE system and effectively becomes their employee for the duration of the contract. The agency pays the contractor a fixed rate while charging the client an uplifted amount to cover their fee and administrative costs.

The agency deducts Income Tax and National Insurance from the contractor’s rate and pays the net amount into their personal bank account. There are rarely additional costs to the contractor as the agency factors administrative and employer costs into what they charge the end client.

Although this may make it seem like Agency PAYE is better than operating through an umbrella company, a contractor’s net take home is usually the same. End clients should offer inflated rates for umbrella company contractors to reflect that they pay the employer’s costs directly. However, how accurately rates are inflated has been a point of contention since the IR35 rules emerged.

iii) Limited Company

Most contractors are unaware that you can technically continue working through your limited company while working inside IR35. Our guide to IR35 and Limited Companies explains how this works in theory.

In reality, very few contractors work this way as end clients refuse to work with contractors on an inside IR35 basis unless it is via an umbrella company or agency PAYE.

iv) Fixed-Term Contract

Contractors working on fixed-term contracts are employed directly by the end client for a specific period. As the contractor is an employee, there is no intermediary, and the IR35 rules do not apply.

By law, the employer treats the contractor the same way they treat other employees on a permanent basis. The contractor receives equal treatment to other employees for the contract duration. They have unfair dismissal and redundancy rights, receive the same pay, and pay the same taxes.

It’s worth noting that, although there are technically many options available to inside IR35 contractors, recruitment agencies and end clients frequently specify that they will only accept contractors working through an umbrella company.

Outside IR35 Meaning

Being ‘outside IR35’ means that you are running a genuine business and, therefore, operating outside of the IR35 rules. As an outside IR35 contractor, you are a limited company director, invoicing your client directly and using the company revenues and profits in a way that suits you, just like any other small business owner.

Financially speaking, working outside IR35 means taxes are not deducted at source, and you are not subject to direct PAYE via the fee-payer. Instead, the client pays the entire fee amount to your limited company as revenue. This revenue is subject to corporation tax and a mixture of income tax and dividend tax, depending upon how it is withdrawn.

As you are not subject to PAYE, you must ensure you pay the right amount of tax by submitting a self-assessment tax return at the end of the year. Most contractors working outside IR35 employ the services of a specialist contractor accountant, as the nuances of running a limited company can be tricky.

Trading While Outside IR35

There are several options available:

i) Limited Company

Almost all outside IR35 contractors choose to operate via a personal service company (‘PSC’). A PSC is a limited company set up by a contractor to provide their services; they are usually the sole shareholder and company director.

As a limited company is a distinct legal identity in its own right, the contractor’s personal assets are not at risk should the company face financial hardship.

ii) Sole Trader

A sole trader is a self-employed individual who is the sole owner of their business. As a sole trader, there is no distinction between yourself and the business; you are considered the same entity. You have absolute control over how the business is run and are entitled to keep 100% of the profits.

Although technically possible, outside IR35 contractors rarely work as sole traders. Most end-hirers won’t work with them as there is a risk that the sole trader could seek to claim employment rights from the hirer (as is common in the construction industry).

From a contractor’s point of view, not only are there financial benefits involved with working through a limited company, but sole traders also face virtually unlimited liability. Their personal assets could be at risk in the face of litigious clients.

See our guide to IR35 and Sole Traders for further details.

iii) Umbrella Company

An outside IR35 contractor can, in theory, decide to work through an umbrella company. As with an inside IR35 contract, the umbrella company would invoice the client and then deduct all relevant taxes before paying the contractor net.

In practice, this is rarely done as it removes any ability to distribute earnings tax-efficiently. The only time outside IR35 contractors consider working through an umbrella company is if the contract is short or if they are considering moving to a permanent position. In these cases, they may not want the administrative burden of running a limited company.

What Is The Cost of IR35?

Since IR35 was first introduced, contractors have tried to ensure they operate as a genuine business outside IR35. Operating in this way ensures they can pay themselves a tax-efficient salary and dividend split. Drawing a small salary minimises income tax exposure and employer and employee national insurance (NI) contributions.

But what happens to those contractors that are caught by the IR35 rules? What is the cost of IR35?

In the following article, we try to quantify the cost of IR35 by comparing various scenarios for two contractors, Jack and Jill. Both charge a daily rate of £500; however, Jack works inside IR35 via an umbrella company, while Jill works outside IR35 via a limited company.

The following calculations assume 230 working days, and use tax rates from 2024/2025.

The Cost of IR35

At £500 per day, Jack has annual taxable earnings of £100,705, pays £33,388 in tax and has a take-home of £67,317.

Jill has annual taxable earnings of £91,254, pays £16,956 in tax and has a take-home of £74,298. The lower taxable earnings and disparity in the amount of tax paid by Jill owe to the fact that her limited company has already paid £23,267 in corporation tax.

That is a difference of £6,981 per year, or 9%. To earn an equivalent take-home while working inside IR35, Jack must charge a daily rate of £590, an 18% increase from what he currently earns. The cost of being caught by IR35 is, therefore, significant.

The difference in take-home is driven by Jack and Jill paying different types of tax. Jack’s income is taxed at source, so he pays income tax and Employee National Insurance. Jill’s income is structured in such a way that she pays no income tax or Employee National Insurance, instead paying a combination of corporation tax and dividend tax.

While Jack and Jill both pay Employer’s National Insurance contributions on their salaries, Jack has to pay a whopping £12,641 for the year, while Jill pays just £479. This is the most common complaint regarding IR35 and working through an umbrella company, classifying contractors as employees and then making them responsible for paying taxes usually paid by an employer. See our guide to Umbrella Company National Insurance for further details.

But what happens if the daily rate changes? Does this impact the difference in Jack and Jill’s take-home pay? The answer is, surprisingly, yes.

At £300 per day, Jack has an annual take-home of £44,116, while Jill’s is £51,899, a difference of 15%. At £700 per day, Jack has an annual take-home of £85,772, while Jill’s is £91,058, a difference of 6%.

Although the inequality appears to decrease the higher the daily rate charged, this isn’t actually beneficial. It simply reflects that the difference between the dividend and income tax rates reduces the more you earn. Higher earners pay higher tax rates on the income that falls into the respective bucket, a key reason working outside IR35 via a limited company is so attractive. It facilitates effective tax planning.

Effective Tax Planning

The above calculations assume that Jill withdraws all cash from her limited company in the year it was earned and has no allowable expenses. While this allows us to identify a general parallel between inside IR35 and outside IR35 take-home rates, it does not reflect reality.

In truth, working outside IR35 through a limited company allows Jill to choose how she withdraws her money from the business. She can select from several different strategies to minimise her tax liabilities effectively. Allowable expenses reduce the corporation tax liability, delaying payment of a dividend to the following tax year reduces the amount captured by higher rate tax brackets, and leaving revenue in the company as retained earnings enables claiming Business Asset Disposal Relief (‘BADR’) upon winding up.

Of these, BADR is the most effective way contractors can reduce their tax bill. Our guide to Closing Your Limited Company explains BADR in detail; however, to summarise, BADR turns a dividend into a capital repayment. Instead of paying the relevant dividend tax rate, contractors pay a reduced capital gains rate on qualifying disposals of 10%.

When considering tax planning, the disparity between inside IR35 and outside IR3 take-home increases significantly. Take the £500 per day example above. If Jill decides to leave 25% of her net profit in the company as retained earnings, she can claim BADR upon closing the company. This results in a total capital gain of £78,970: £61,266 from standard take-home and £17,704 from BADR.

That is a difference of £11,653 per year to Jack’s take-home or 15%. To earn an equivalent take-home while working inside IR35, Jack must charge a daily rate of £640, a 28% increase from what he currently earns.

Pension Contributions

As taxes are deducted at source for inside IR35 contractors, pension contributions are the only tax planning tool available. Maximising pension contributions reduces tax liability and increases total capital gained (this is different from take-home pay). This is also a popular strategy for outside IR35 contractors as well.

In our example above, if Jack decides to contribute 50% of his relevant earnings to his SIPP via salary sacrifice, he would have a total capital gain of £93,915: £40,293 from standard take-home and £53,712 from pension contributions. This is a substantial improvement over the £67,317 take-home achieved with no pension contributions.

If Jill were to do the same, she would have a total capital gain of £100,761: £43,261 from standard take-home and £57,500 from pension contributions. That is a difference of £6,846 per year to Jack’s take-home or 7%.

Summary

Every contractor’s working arrangements and earning profile differ, so identifying a single figure that can quantify the cost of being caught by IR35 is impossible. It can vary based on days worked, other sources of income, expenses, allowances, tax rates etc.

As such, there are some inherent limitations in the above calculations. For example, they do not consider the impact of allowable expenses outside IR35 contractors can offset against corporation tax. Pension contributions are simplified as well. While maximising pension contributions makes sense from a hypothetical tax reduction perspective, many contractors can’t afford to lock away such a high proportion of their income until they retire.

The same can be said about BADR. While it is a fantastic form of tax relief, it is only claimable once a company is wound down (i.e. closed). Until then, the money is stuck in the business and can’t be accessed. It also comes with the caveat that you can’t start another limited company in a similar industry for two years.

This article hopefully demonstrates that, while the difference between inside IR35 and outside IR35 take-home pay can be substantial, increasing your day rate to reflect the increased tax burden can go some way to reducing the deficit. Asking for a 20% to 30% uplift on your outside IR35 rate should result in similar take-home.

Although by no means a perfect resolution, working an inside IR35 contract is not the end of the world.

IR35 Assessments

Navigating the intricate landscape of UK tax legislation is no easy feat, especially for contractors. Amidst the myriad of regulations, one term stands out prominently: IR35. But what are IR35 assessments, and how is status determined?

Without a proper understanding, your status could be incorrect. If your status is incorrect, you could be underpaying the tax you owe HMRC. Contractors caught underpaying tax, even if it is a genuine mistake, could be subject to interest on the money owed and additional penalties.

In this comprehensive guide, we delve deep into the heart of IR35. Whether you’re an aspiring contractor or a seasoned veteran seeking clarity, this guide aims to demystify IR35, empowering you with the knowledge to make informed decisions and remain compliant

When Does IR35 Apply?

If you are a UK resident for tax purposes and are considering contracting through an intermediary (i.e., a limited company), IR35 must always be considered. The only variability is around whose responsibility it is to conduct the IR35 assessment.

This is an important point that often confuses new contractors who believe that working with small businesses or overseas clients exempts them from IR35. They are incorrect. Working with small companies or overseas clients means the contractor is responsible for the IR35 assessment and is liable should HMRC investigate and find it faulty.

Who Performs The IR35 Assessment?

- The client is in the public sector; or

- The client is in the private sector and classified as a medium or large company.

- Have an annual turnover of more than £10.2 million;

- Have a balance sheet total of more than £5.1 million; or

- Have more than 50 employees.

- The client is in the private sector and classified as a small company (i.e. does not meet the definition of medium or large); or

- The client is classified as ‘wholly overseas’ with no UK presence.

How is IR35 Status Determined?

There is no ‘HMRC approved’ template for IR35 assessments. Instead, those responsible must review the contract and the day-to-day working realities against the IR35 rules. HMRC look at both when performing an investigation.

The IR35 rules

IR35 Assessment Process for Contractors

The responsibility for performing the IR35 assessment lies with the contractor only if you provide services to a private sector client defined as a small company under the Companies Act 2006 or a foreign business classed as ‘wholly overseas’. The end client/fee-payer is responsible for the assessment in all other situations.

Contractors that have to perform their own IR35 status determination should note that there is no specific assessment process. Instead, you need to consider the IR35 rules in conjunction with the written terms of your contract and the day-to-day working arrangements.

When performing the assessment, it’s essential to remember that genuine outside IR35 contracts are business-to-business relationships. The contract will likely be inside if any indications of ‘disguised employment’ exist.

Given the potential costs of getting an assessment wrong, I recommend that contractors who have to perform the review themselves opt for professional help in the form of a contract review. QDOS’ IR35 Contract Review service offers a concise assessment of your contract and working practices, providing a comprehensive report of the engagement’s IR35 status with a clause-by-clause analysis and straightforward suggestions for positive changes.

Warning Over HMRC's IR35 CEST Tool

HMRC claims that their Check Employment Status for Tax (CEST) tool can help determine whether you are inside or outside IR35 for tax purposes. The tool provides HMRC’s view of a worker’s employment status based on the information provided, although using the CEST tool when making employment status decisions is not compulsory.

HMRC has pledged to stand by the results of the CEST tool if the information entered is correct; however, contractors should be wary about using it. Data released by HMRC show that of more than 1 million tool users, 21% did not receive a precise result.

In addition, at least three government bodies were fined after failing to correctly assess the employment status of their contractors, with two of the departments using CEST as their sole assessment method.

Relying on CEST alone isn’t a smart move due to its unreliable nature, and the issues don’t stop there. The tool is too simple and lacks the detail required to assess every contractor accurately. Users have also complained that it is confusing and open to misinterpretation.

What Are The IR35 Rules?

When performing a status assessment, the party responsible must consider the written contract and the day-to-day working practices against a framework known as the ‘IR35 rules’.

Against these rules, the assessor must decide whether the engagement would be one of employment or self-employment without a limited company intermediary. Is the contractor running a genuine business, or are they operating as a disguised employee?

Three fundamental principles need to be considered: (i) supervision, direction and control, (ii) substitution, and (iii) mutuality of obligation.

Supervision, Direction and Control

- Does the contract specify when I can start and finish, or the days I must work?

- Does the contract state that the client can oversee my work and give guidance on how to complete it? Does anyone have the right to tell me how to do my job?

- What are the practical arrangements of the contract? Am I providing services for the agreed job or working on different tasks as the client sees fit?

Substitution

- Does the contract contain a specific ‘Right of Substitution’ clause?

- Could I bring someone else in to complete the contract, or do I need to do the work yourself?

- Does my client only want me or my services more broadly?

Mutuality of Obligation

- Is there an obligation on the employer’s end to offer work, and do I need to accept it?

- Can I work for other clients simultaneously, or is this restricted?

Working Practices

Supervision, direction and control, right of substitution and mutuality of obligation are all contractual clauses reviewed during an IR35 determination. However, there is no point in having a watertight, ‘outside IR35’ contract between yourself and the client unless it mirrors the reality of the day-to-day working arrangements.

When performing an IR35 enquiry, HMRC reviews both the contract and your working practices to establish if the assessment is correct. The contract must reflect your working practices – essentially, the clauses must be genuine.

HMRC consider additional criteria when working out IR35 status:

- Equipment: HMRC often tries to argue that if the client provides equipment and you don’t use your own, you’re a disguised employee.

- Financial risk: Self-employed contractors usually take a degree of financial risk, like any other business, and there’s usually a requirement to have professional indemnity insurance.

- Part of the organisation: Does the contractor attend Christmas parties? Are they part of the company structure? If the contractor has a team reporting to them, it could indicate employment.

- Exclusivity: Does the contractor work for other clients? Typically, the self-employed can work for multiple clients at once.

- Genuine business: This determines whether the contractor runs their limited company as a business. For example, does it have a website

It’s important to note that the above points are insufficient to indicate inside or outside IR35.

Using your own IT equipment often isn’t practical; clients frequently insist that contractors work on their equipment. This scenario is often unavoidable, especially for IT contractors. It’s not an indicator of being inside IR35. Instead, it is usually a prerequisite for ensuring security protocols and limiting access to secure data.

The same can be said for having a company website. If you are a contractor who sources most of their work via job boards and recruitment agencies, you may have no practical reason to have a company website. Building one for the express purpose of appearing outside IR35 holds no sway should HMRC open an enquiry.

Notice Periods

As notice periods are reminiscent of an employee and employer relationship, the ideal outside IR35 contract would not have one. Either party should be able to terminate the contract without notice.

However, enforcing no notice periods is not always practical, and many clients insist on including them in the contract. In such situations, the notice period should be as short as possible.

Summary

Contractors should remember that genuine outside IR35 engagements are business-to-business relationships, with the contract being one ‘of service’ instead of ‘for services’. The key areas that need to be present for the contract to be outside IR35 are:

- Supervision, Direction and Control: The contract should stipulate that the contractor can provide services via their own methods;

- Substitution: There should be a genuine right of substitution clause; and

- Mutuality of Obligation: The obligations of both parties should be clearly outlined to ensure there is no obligation for further work when the contract ends. An end date should be stated.

A well-drafted contract that clearly outlines the above is not enough in itself; you need to demonstrate that the clauses mirror the actual working practices.

IR35 Compliance And Protection

Navigating the intricate landscape of UK tax legislation is no easy feat, especially for contractors. Amidst the myriad of regulations, one term stands out prominently: IR35. But what does IR35 compliance look like, and how can you protect yourself against an HMRC IR35 investigation?

In this comprehensive guide, we delve deep into the heart of IR35. Whether you’re an aspiring contractor or a seasoned veteran seeking clarity, this guide aims to demystify IR35, empowering you with the knowledge to make informed decisions and remain compliant.

HMRC IR35 Investigation Trigger

HMRC carry out several thousand random inquiries annually; anyone can receive notice of an IR35 investigation. Contracts can be evaluated up to six years in the past to see where legislation should have applied.

Contractors can also trigger an IR35 enquiry due to exhibiting certain suspicious behaviours. HMRC monitors all businesses and individuals via their submissions (i.e. VAT Returns, Confirmation Statements, Company Accounts, Self-Assessment Tax Returns), using this data to refine their risk profiling and targeting strategies.

HMRC seeks to narrow those cases subject to investigation by considering a range of factors, including engagement patterns, the nature of the company, the sector of operation and financial irregularities. They prioritise individuals for review if they see any indication that the limited company is merely a vehicle of convenience instead of a genuine business.

HMRC’s systems are likely programmed to look for identifiers like an individual operating through a limited company who is the sole director, has a spouse as a shareholder, has changeable turnover, a fluctuating gross profit rate, minimal expenses and pays the minimum wage but significant dividends.

The subsequent investigation may not find the individual inside IR35; indeed, many legitimately outside IR35 contractors operate this way.

IR35 Investigation Process

i) Request For Information

ii) Review of Information

iii) HMRC's Decision

Consequences of Getting IR35 Wrong

Being investigated by HMRC does not automatically mean you are a disguised employee. If you take the investigation seriously, seek professional advice, and your contract is genuinely outside IR35, you should be fine.

However, if HMRC determines your status assessment is wrong and you have incorrectly been working outside IR35, additional income tax and National Insurance is owed on the work performed. Depending on the circumstances involved, HMRC also has the discretion to issue a penalty.

The severity of the penalty is based on the reason for the inaccurate determination. If HMRC deems the responsible party:

- Was unaware or careless but didn’t know the assessment was inaccurate, they can be liable for a penalty of 30% of the tax bill.

- Was deceptive and knew the contract was within IR35 but chose not to act, they can be liable for a penalty of 70% of the tax bill.

- Actively intended to conceal the employment status and purposely engaged in tax avoidance activities, they can be liable for a penalty of 100% of the tax bill.

Who is Responsible?

The party responsible for paying the additional tax liabilities, late interest, and penalties is the same party responsible for performing the original Status Determination Assessment. This depends on the client’s industry, business size, and location, with further detail provided in our guide on IR35 Assessments?

In summary, the liability lies with you as a contractor if you provide services to a client in the private sector classed as a small company or provide services to a business classified as ‘wholly overseas’.

The consequences of getting IR35 wrong can potentially be crippling. Legal fees, taxes, interest, and penalties can all follow an HMRC investigation. Although the recent reforms place responsibility on the fee payer in most circumstances, there is still a significant downside for contractors involved in an IR35 investigation.

Maintaining IR35 Compliance

i) IR35 Contract Reviews

Many companies specialising in contractor tax legislation or insurance offer independent IR35 contract reviews. These contract reviews provide an assessment of both your contract and working practices.

Ranging from £50 to £150, depending on the complexity of the feedback provided, an IR35 contract review will give an expert opinion on whether the contract sits inside or outside IR35.

They aim to identify clauses where HMRC may find an issue and often provide a list of recommended changes. These proposed changes afford you the opportunity to restructure any contractual provisions or working practices that may not be IR35 compliant.

By proactively undertaking an IR35 contract review, you demonstrate to HMRC that you have taken ‘reasonable steps’ to ascertain that your status lies outside of IR35. HMRC look favourably on this, and it will potentially reduce any penalties owed in the unlikely event a ruling should go against you.

ii) IR35 Insurance

HMRC can open an IR35 enquiry at any time for any reason. These investigations can be lengthy and costly, and without the guidance of a tax legislation expert, they can be challenging to defend. Having adequate IR35 insurance is therefore critical to ensuring peace of mind.

IR35 insurance primarily protects contractors from the extreme costs that can follow an IR35 enquiry. Depending on the policy, IR35 insurance can cover everything from expert representation to any tax liabilities, interest and penalties owed at the end of the investigation.

Although IR35 insurance is not mandatory, many contractors prefer to take out a policy to ensure someone with experience is fighting their corner should the worst happen. Qdos are a specialist insurance provider that offers comprehensive IR35 contract assessments and tax enquiry insurance.

IR35 Expenses

Navigating the intricate landscape of UK tax legislation is no easy feat, especially for contractors. Amidst the myriad of regulations, one term stands out prominently: IR35. But what are the allowable IR35 expenses? How do the off-payroll rules impact what you can claim?

In this comprehensive guide, we delve deep into the heart of IR35. Whether you’re an aspiring contractor or a seasoned veteran seeking clarity, this guide aims to demystify IR35, empowering you with the knowledge to make informed decisions and remain compliant.

Outside IR35 Expenses

Contracts that fall outside of the scope of IR35 allow contractors to work via limited companies, claiming all allowable expenses.

As a limited company owner, business expenses reduce profits before tax. This, in turn, reduces the amount of corporation tax owed to HMRC. More allowable expenses mean less taxable profit and a lower tax liability.

For an expense claim to be ‘allowable’, it must be incurred ‘wholly and exclusively’ for the purposes of business. The terms’ wholly’ and ‘exclusively’ are designed to prohibit expenditure that serves a dual purpose, a business purpose, and a non-business purpose.

Further details can be found in our guide to Limited Company Expenses.

Inside IR35 Expenses

Claiming expenses while inside IR35 is notoriously tricky. In April 2016, HMRC legislation came into effect, severely restricting what could be claimed by contractors deemed to be operating in a manner equivalent to that of a permanent employee.

While expenses can still be paid, they must be agreed with the end client and paid in addition to your standard contract rate. Unlike limited company contractors working outside IR35, you cannot offset expenses against your earnings.

Similar to permanent employees, all expense claims must be submitted, approved, and reimbursed on top of regular income.

The easiest way to think about IR35 expenses is to think of yourself as a permanent employee of the end client. If a permanent employee can seek reimbursement for something, it is likely you can as well. If they can’t, you can’t.

IR35 and Travel Expenses

Under the new provisions that came into effect in 2016, any travel and subsistence while working inside IR35 will be treated as if the engager employed the contractor directly. No relief is given for home-to-work travel costs and associated subsistence.

Inside IR35, contractors can only seek reimbursement for travel and subsistence expenses if they relate to the performance of their duties or travel to a ‘temporary’ workplace. These expenses must be approved by the client and paid in addition to the standard contract rate.

No relief is available for ordinary commuting, which is travel between home (or a place that is not a workplace) and a ‘permanent workplace’. HMRC outline several criteria for identifying what constitutes a permanent workplace.

IR35 and Accommodation Expenses

The 2016 changes to travel and subsistence allowances also impact accommodation expenses. Inside IR35 contractors can no longer claim costs such as hotels unless approved and reimbursed by the fee payer.

IR35 and Pension Contributions

Contractors working inside IR35 can continue to claim tax relief on pension contributions, regardless of whether they work in the public or private sector. We’ve written a detailed guide to umbrella company pensions that explains the options available to inside IR35 contractors.

IR35 and the 5% Rule

Prior to April 2021, contractors working inside IR35 were entitled to claim a 5% general expense allowance. This 5% was a flat rate, calculated on the gross fees receivable, and was designed to cover administration costs such as insurance, working from home, accountancy and training.

Since April 2021, new rules have significantly curtailed who can claim the 5% allowance. For all public sector and most private sector contracts, the 5% allowance no longer exists.

The only exception is if the contract sits within the private sector and the client is deemed a ‘small company’. A small company will fall under two or more of these requirements:

- Turnover of no more than £10.2 million;

- Balance sheet total of no more than £5.1 million;

- No more than 50 employees.

IR35, Foreign Companies and Overseas Contractors

International markets can provide lucrative opportunities for UK contractors willing to work with overseas clients. Historically, the jurisdiction of the end client had minimal impact on a contractor’s IR35 status, as a contractor’s UK tax obligations were their responsibility only.

However, the changes to the IR35 rules in April 2021 mean that contractors are no longer responsible for determining their IR35 status. Most of the time, the responsibility now lies with the end client or agency that pays the contractor.

Many overseas clients are unaware of the UK’s IR35 legislation or are uninterested in the time-consuming process of providing a status determination assessment. HMRC have no jurisdiction over non-UK-based companies and cannot force compliance with the IR35 rules.

IR35 and Overseas Clients

If you are a UK resident contractor working for an overseas client, then IR35 still applies. Just because you work for a foreign company outside the UK or are paid in a foreign currency does not mean you can ignore IR35.

This confuses a lot of contractors who think IR35 no longer applies if their client is not based in the UK.

IR35 and whether a contract is inside or outside relates to the contractor’s working practices; it has nothing to do with where the end client is located. The only potential difference is who performs the IR35 status determination assessment.

See our guide to IR35 Assessments for further a helpful decision tree.

IR35 and Foreign Companies

The UK government sought to clarify the confusion around IR35 and foreign companies in the Finance Bill 2020. Organisations without a UK presence, considered ‘wholly overseas’, are removed from the IR35 responsibility chain.

Instead, where a client is wholly overseas, the pre-April 2021 rules will apply, and it will be up to the contractor themselves to determine IR35 status. The responsibility and, most importantly, the liability is returned to the contractor.

It is up to the contractor to evaluate their own IR35 status and, if they assess themselves as Inside IR35, make the relevant income tax and national insurance payments. Should HMRC conduct an IR35 investigation, any additional tax and penalties arising from an incorrect assessment will be payable by the contractor.

Where a contractor has an end client based wholly overseas, the 2021 IR35 reforms will not apply, and the contractor must assess their IR35 status themselves.

What Does 'Wholly Overseas' Mean?

According to the gov.uk website, “an organisation is classed as overseas if it does not have a UK connection”. HMRC consider the definition of having ‘no UK connection’ to be where:

- The client does not have residency in the UK; and

- The client has no permanent establishment in the UK.

A permanent establishment in the UK is usually a branch or a local office. If the client is based overseas but has a branch or local office in the UK, no matter how small, the second test is not passed. The business is not wholly overseas, and they retain responsibility for determining IR35 status.

They are liable for any additional taxes or penalties arising from an incorrect assessment, and HMRC will pursue any outstanding obligations through the UK establishment.

What if the Fee-Payer is a UK-Based Agency?

Where the client is based wholly overseas, the responsibility for determining IR35 status (and any subsequent liability) falls to the contractor regardless of the contractual chain and who the fee-payer is. Any agencies involved in the process do not need to consider IR35.

IR35 and Overseas Contractors

IR35 does not apply when you have no liability to tax or National Insurance contributions in the UK. Therefore, if you are a contractor based overseas and you qualify as a non-UK resident via the Statutory Residence Test, the IR35 legislation does not apply.

To reiterate, IR35 is irrelevant if you are a foreign contractor, but it will always apply (regardless of the end client’s location) if you are a UK resident for tax purposes.

IR35 and Overseas Contractors

IR35 does not apply when you have no liability to tax or National Insurance contributions in the UK. Therefore, if you are a contractor based overseas and you qualify as a non-UK resident via the Statutory Residence Test, the IR35 legislation does not apply.

To reiterate, IR35 is irrelevant if you are a foreign contractor, but it will always apply (regardless of the end client’s location) if you are a UK resident for tax purposes.

IR35 and Limited Companies

Navigating the intricate landscape of UK tax legislation is no easy feat, especially for contractors. Amidst the myriad of regulations, one term stands out prominently: IR35. But can you continue working through your limited company if you are caught by IR35?

In this comprehensive guide, we delve deep into the heart of IR35. Whether you’re an aspiring contractor or a seasoned veteran seeking clarity, this guide aims to demystify IR35, empowering you with the knowledge to make informed decisions and remain compliant.

Working Inside IR35 Through a Limited Company

IR35 is forcing many career contractors used to working through a limited company to review their working arrangements. Some have moved into direct employment, while others have been forced to work through an umbrella company.

While these solutions offer a more straightforward way of ensuring IR35 compliance, they often mean closing your personal services company. There is, however, another option.

While not common practice, it is possible to continue working through a limited company if your current contract is determined to be inside IR35. You don’t have to sign on with an umbrella company immediately.

That said, while it is technically possible, most clients will refuse to hire contractors who work through a limited company while Inside IR35. They will have preferred methods of engagement, usually via an umbrella.

Contractors that can work via their limited company while inside IR35 will have taxes deducted at source by the fee payer (usually the client). The fee payer will allocate a tax code and make the relevant deductions for employers’ national insurance, personal income tax and national insurance.

The remaining amount is then paid to the limited company along with any VAT owed. As the fee payer has already deducted tax from the monies paid to the limited company, the contractor does not need to pay further personal taxes (income, NICs, or dividends), and the company does not need to pay any corporation tax on the received amount.

The contractor can take the total amount as a tax-free salary, transferring the money from the limited company directly to their personal bank account with no additional funds owed to HMRC. There is no double taxation. This video explains the process in detail.

Contractors working through a limited company while Inside IR35 should remember to check the amount of income tax deducted from the source by the fee payer. The fee payer only has sight of the current contract; they do not have knowledge of any other money the contractor may be earning.

For example, a basic rate of 20% of income tax may be applied despite the contractor being a higher or additional rate taxpayer. If this occurs, the contractor must pay any outstanding tax through their self-assessment at the end of the year.

When is it Viable?

Working Inside IR35 via a limited company may be viable if:

- End Client Insists: Although most end clients insist on engaging Inside IR35 contractors via an umbrella company, some prefer the limited company option.

- Multiple Assignments: If you are working on multiple contracts, some caught by IR35 and some not, you may decide it’s easier to run them all through the limited company. Operating via a limited company retains the ability to accept contracts both inside and outside IR35.

What are the Limitations?

The inherent limitation of working via a limited company while inside IR35 is that many clients will refuse to engage you. They do not want to adopt the additional responsibility of allocating a tax code and making relevant tax deductions.

In addition, a lack of clarity regarding the IR35 rules means that clients insist on contractors using an umbrella company. Despite working through a limited company being a perfectly acceptable way to operate, clients do not want to risk being incorrect in their approach and exposing themselves to potential tax liabilities.

It’s also worth noting that, despite working through a limited company, if your contract is Inside IR35, you are still significantly restricted by the expenses you can claim.

Outside IR35 and Limited Companies

If your contract is outside IR35, you operate as a genuine business-to-business relationship and can work through a limited company. You earn revenue, claim expenses, and can take advantage of efficient tax planning arrangements.

IR35 and Sole Traders

Navigating the intricate landscape of UK tax legislation is no easy feat, especially for contractors. Amidst the myriad of regulations, one term stands out prominently: IR35. But does IR35 apply to sole traders?

In this comprehensive guide, we delve deep into the heart of IR35. Whether you’re an aspiring contractor or a seasoned veteran seeking clarity, this guide aims to demystify IR35, empowering you with the knowledge to make informed decisions and remain compliant.

Does IR35 Apply to Sole Traders?

A sole trader is someone who owns 100% of an unincorporated business. As a sole trader, you and your business are legally one entity; you are not distinct in the way a limited company is from its owners.

IR35 does not apply to sole traders as they operate as self-employed individuals. The IR35 legislation only applies to contractors working through intermediaries (such as a limited company). Although IR35 does not apply to Sole Traders, the issue of employment status for tax purposes remains. The rules for determining employment status are similar to those for determining IR35 status.

Which employment status tax legislation applies to you as a sole trader is determined by whether you’re a direct hire or working via an agency.

i) Working as a Direct Hire

For sole traders engaged directly, the hiring organisation must consider traditional employment status tests. These tests are similar to IR35, covering substitution, mutuality of obligations, supervision, direction and control.

The end client decides your employment status, whether you are genuinely self-employed or operating as an employee. Like IR35, if a sole trader works for a client in a way that could be deemed disguised employment, the end client is at risk of being considered the employer. They would be liable for any unpaid income tax and National Insurance contributions should the correct amount not be paid to HMRC, not the sole trader.

ii) Working Via an Agency

For sole traders engaged via an agency, the agency placing the contractor must consider the Onshore Intermediaries legislation. The agency is responsible for determining the contractor’s employment status.

The assessment criteria used are a simplified version of IR35, limited to whether the contractor works under supervision, direction or control. Any supervision, direction or control over the sole trader’s services could indicate disguised employment.

If this applies, the agency is responsible for deducting the relevant taxes and is liable for anything unpaid should the assessment be wrong. It is for this reason most agencies are not prepared to engage with sole traders if they are not subject to PAYE; they are not willing to accept the additional liability.

Why Contractors Don't Work As Sole Traders

i) Additional Tax Liability

Similar to IR35, if a client hires a sole trader as a contractor and is subsequently subject to an HMRC investigation over their employment status, they are liable for any additional income tax, National Insurance contributions, penalties, or fines. Most are unwilling to take on this risk.

ii) Employment Rights

As no intermediary (limited company etc) separates the contractor from the client, a contractor is one step closer to the employer. Therefore, there is a greater risk that an individual trading as a sole trader could look to claim employment rights from the client, a common occurrence in sectors such as construction.

In addition to the above, operating as a sole trader has downsides for the contractors themselves. For a sole trader, there is no distinction between business and individual. You hold personal responsibility for the businesses’ debts and may have to sell off personal assets to meet those debts should something go wrong.

See our guide on Limited Company vs Sole Trader for further details.